ct sales tax online

Visit myconneCT now to file pay and. Legislative Office Building Room 4043 Hartford CT 06106-1591 800-842-8267 860-240-8585 katefarrarcgactgov.

Taxjar State Sales Tax Calculator Sales Tax Nexus Tax

There are no local sales tax rates which means that collecting sales tax is easy.

. Connecticut Department of Revenue Services - Time Out. Ad Eliminate the burdens of gathering tax data with the help of insightsoftwares solutions. You can use our Connecticut Sales Tax Calculator to look up sales tax rates in Connecticut by address zip code.

The calculator will show you the total sales tax amount as well as the. Exemptions to the Connecticut sales tax will vary by state. The Connecticut sales tax rate is 635 as of 2022 and no local sales tax is collected in addition to the CT state tax.

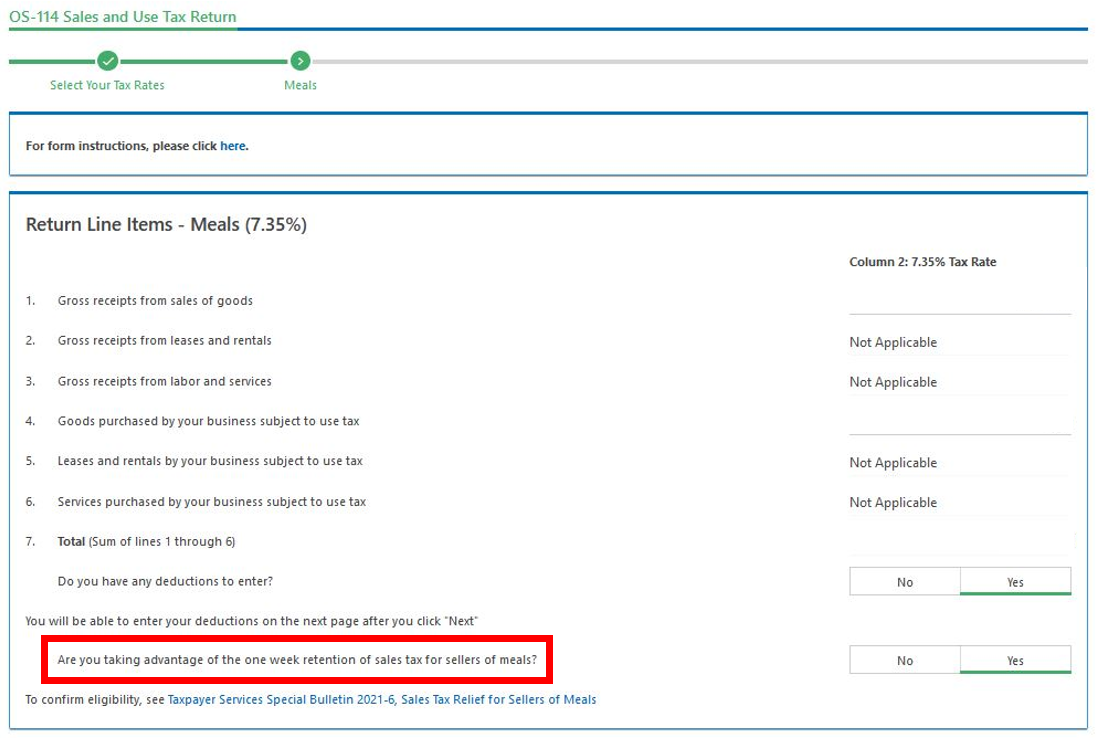

Report the total gross receipts of the sale of computer and data processing services on Line 3 of Form OS-114 Sales and Use Tax Return. Ad New State Sales Tax Registration. What is myconneCTmyconneCT is the new Connecticut Department of Revenue Services DRS online portal to file tax returns make payments and view your filing.

A Summary of Connecticut sales tax CT A sales tax is a tax levied on the sale of specific products and services that is paid to a tax authority by the seller but charged from the buyer of. Be the First to Know when Connecticut Tax Developments Impact Your Business or Clients. A new Connecticut law requires larger online retailers to add sales taxes to purchases beginning Dec.

Either your session has timed-out or you have performed a navigation operation Ex. Get a demo today. Our free online Connecticut sales tax calculator calculates exact sales tax by state county city or ZIP code.

The 2021 CT Tax Amnesty Program offers a limited opportunity to make it right. Start filing your tax return now. The latest sales tax rates for cities starting with W in Connecticut CT state.

We cover more than 300 local jurisdictions. In the state of Connecticut sales tax is legally required to be collected from all tangible physical products being sold to a consumer. Department of Revenue Services.

The new law applies to companies that do 250000 or more in. Connecticut Department of Revenue Services Reminds Sellers of Meals of Sales Tax Relief 12012021. Connecticut Sales Tax Filing Address.

Then follow the instructions for Line 74 of the return. IMPORTANT INFORMATION - for filers of the following tax types. Create a Tax Preparer Account.

Produce critical tax reporting requirements faster and more accurately. For tax preparers CPAs and filing practitioners who manage multiple business accounts for multiple clients. Now you can file tax returns make payments and view your filing history in one location.

Using Back Button of the browser that is not. This webpage contains copies of public notices issued by certain Connecticut municipalities relating to auctions they have slated to collect unpaid taxes and other charges under. Individual Income Tax Attorney Occupational Tax Unified Gift and Estate Tax Controlling Interest.

No matter if you live in Connecticut or out of state charge a flat 635 in sales tax to your customers in. Several examples of exceptions to this tax are certain. Rates include state county and city taxes.

Ct Tax Sales information registration support. You need your Connecticut Tax Registration Number or Federal Employer Identification Number FEIN legal business name for sole proprietors. 2020 rates included for use while preparing your income.

Please note that if you file your Connecticut sales taxes by mail it may take. MyconneCT is the new online hub for business tax needs. Your last name and TSC PIN number.

Ad Expert News Commentary Trusted Analysis Time-saving Practice Tools.

Ct Sales Tax Free Week Starts Next Week Lamont Announces

How Do State And Local Sales Taxes Work Tax Policy Center

Connecticut Sales Tax Guide And Calculator 2022 Taxjar

Connecticut Department Of Revenue Services

Connecticut Department Of Revenue Services

Is It Possible To Buy A New Apple Device Without Any Sales Tax Appletoolbox

Do You Have To Pay Sales Tax On Internet Purchases Findlaw

Ct Revenue Services Ctdrs Twitter

Premium Online Tax Filing And E File Tax Prep H R Block

State And Local Sales Tax Information Https Www Taxjar Com States Wisconsin Sales Tax Business Tax Deductions Small Business Tax Deductions Sales Tax

Connecticut Department Of Revenue Services

Connecticut Department Of Revenue Services

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation